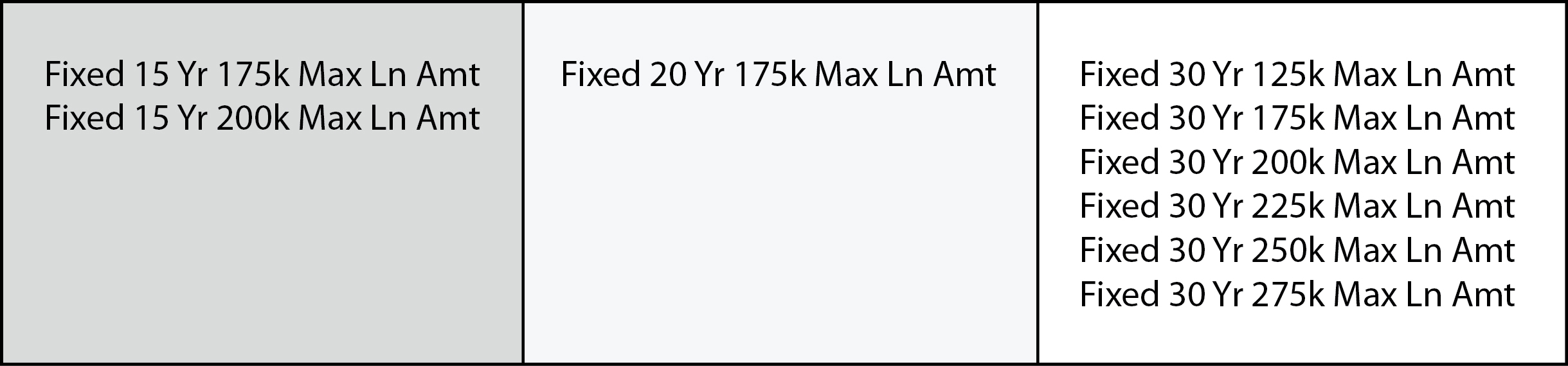

Last April, FHLBank Topeka began offering low loan balance pricing pay-ups for the Mortgage Partnership Finance® (MPF) Program’s Conventional, Traditional products. We initially activated five tiers for the 15-, 20-, and 30-year fixed rates.

Beginning today, we are activating an additional four tiers for all Participating Financial Institutions with MPF Conventional, Traditional master commitments (MPF Original and MPF 125). The additional pricing options are available along with the existing tiers on the eMPF® website and will also be reflected in the product pricing engines.

There will now be nine total pricing grids available for low loan balance pricing.

These pricing options provide your institution with access to expanded pricing on low balance loans, which can help attract new customers and result in increased profitability.

To learn more about how the new pricing schedules can benefit your mortgage best execution analysis, read this short article. If you have additional questions, about the low loan balance pricing option, contact Chris Endicott at 866.571.8171 or chris.endicott@fhlbtopeka.com.

“Mortgage Partnership Finance,” “MPF,” and “eMPF” are registered trademarks of the Federal Home Loan Bank of Chicago.