March 28, 2025 - The board of directors approved the following first quarter dividends for both the membership capital stock (Class A) and activity-based capital stock (Class B) at its March 28, 2025, meeting:

- Class A Common Stock: 4.50 percent (per annum)

- Class B Common Stock: 9.50 percent (per annum)

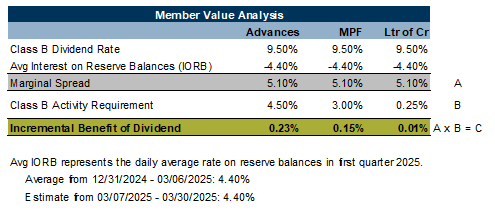

We are pleased to provide continued strong returns on your investment in your cooperative to help build your communities. The table below illustrates the incremental benefit you receive from the Class B Stock dividend as you use each of our three main products – advances, the Mortgage Partnership Finance® (MPF®) Program and letters of credit.

FHLBank Topeka balances maintaining strong capital growth, offering liquidity to members at competitive rates and providing an attractive return on activity-based stock. Based on current market expectations of short-term interest rates, we anticipate paying dividend rates in ranges between 4.00 to 4.50 percent for Class A and 8.75 to 9.50 percent for Class B for the second quarter of 2025.

Over time, our dividend rates have moved directionally with short-term interest rates, and we strive to provide a competitive dividend across various rate environments. Please keep in mind that market conditions and movements in short-term interest rates can be unpredictable. Adverse changes in FHLBank’s financial results may result in lower dividend rates in future quarters than we currently anticipate.

Please contact the Lending Desk or your regional account manager with your questions on the positive impact of the above-market Class B dividend on FHLBank advance rates, letter of credit costs and MPF mortgage loan sales. They can help compare the all-in cost of advances to various deposit pricing strategies and purchased deposit funding options.

The dividends on both classes of stock are payable in the form of Class B Common Stock and will be credited to your institution’s capital stock account at the close of business on March 31, 2025. Any partial shares will be paid in cash and credited to your institution’s demand deposit account on that date as well.

If you have any questions related to the dividend, please contact the Lending Desk at 800.809.2733. We appreciate your continued partnership.

“Mortgage Partnership Finance” and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago.

The information contained in this announcement contains forward-looking statements within the meaning of the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act), such as those pertaining to FHLBank’s objectives, projections, estimates or future predictions of FHLBank’s operations. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance the events or circumstances reflected in the forward-looking statements will occur. These statements may be identified by the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “is likely,” “could,” “estimate,” “expect,” “will,” “intend,” “probable,” “project,” “should,” or their negatives or other variations of these terms. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent FHLBank’s intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond FHLBank’s ability to control or predict. FHLBank cautions that by their nature forward-looking statements involve risks or uncertainties and that actual results may differ materially from those expressed in any forward-looking statements as a result of such risks and uncertainties, including but not limited to: changes in the general economy; political events, including legislative, regulatory, judicial, or other developments that affect FHLBank, its members, counterparties or investors in the consolidated obligations of the FHLBanks, such as any government-sponsored enterprise (GSE) reforms; natural disasters, including those related to climate change, severe weather, public health crises, acts of war or terrorism or other external events; climate change and responses to climate change; governmental responses to an economic downturn, recession, inflation or other macro-level events or conditions; the uncertain, complex body of laws and regulations applicable to the FHLBanks; compliance with anti-money laundering statutes and regulations; competition from alternative loan and funding providers; membership changes, including changes resulting from member creditworthiness, member failures or mergers, changes due to member eligibility or housing mission focus, or changes in the principal place of business of members; a high concentration of advances and capital with a few members; changes in credit ratings of FHLBank Topeka, the other FHLBanks and the U.S. government; regulations relating to privacy, information security and data protection; joint and several liability of all or a portion of the consolidated obligations for which one or more of the other FHLBanks are the primary obligors; declines in U.S. home prices or weaknesses in activity in the U.S. housing and mortgage markets undermining the need for wholesale funding, thus impairing the volume and quality of mortgage loans originated and sold by members; defaults by, and the soundness of financial institutions, including clearinghouses, FHLBank members, non-member borrowers, counterparties and the other FHLBanks and their members, non-member borrowers and counterparties; changes in the fair value and economic value of pledged collateral securing advances or other extensions of credit to FHLBank members or non-member borrowers or collateral pledged by reverse repurchase and derivative counterparties; interruptions in FHLBank’s access to the capital markets; changes and volatility in interest rates and indices and FHLBank’s ability to manage interest rate risk; the ability to enter into effective derivative instruments on acceptable terms; FHLBank’s ability to meet obligations as they come due or meet the credit and liquidity needs of our members in a timely and cost-effective manner; an increase in required Affordable Housing Program (AHP) contributions; FHLBank's ability to declare dividends or to pay dividends at rates consistent with past practices; the lack of a public market and restrictions on transferring our capital stock and associated illiquidity; volatile market conditions impairing the ability of FHLBank’s financial models to produce unreliable results; reliance on counterparties and third-parties to provide accurate and complete information; potential costs and effects of litigation, regulatory actions, investigations or similar matters, or adverse facts and developments related thereto; the ability of FHLBank to keep pace with technological changes and innovation such as artificial intelligence (AI), and the ability to develop and support technology and information systems; cybersecurity threats, cybersecurity risk management and FHLBank’s ability to respond to cybersecurity incidents; judgments, assumptions and estimates in the preparation of our financial statements; effectiveness of FHLBank’s risk management framework in mitigating risks of losses; effectiveness of FHLBank’s internal control over financial reporting to report accurate and timely financial results; employee error and member, employee and third-party misconduct; fraudulent activity; third-party service providers fail to provide, terminate their services or fail to comply with banking regulations; and the ability of FHLBank to attract, onboard and retain skilled individuals, including qualified executive officers. Additional risks that might cause FHLBank’s results to differ from these forward-looking statements are provided in detail in FHLBank’s filings with the SEC, which are available at www.sec.gov.